These entries are made at the end of an accounting period to record transactions that have occurred but have not yet been recorded. Without adjusting entries, financial statements may be 3 ways to do time value money calculations misleading and inaccurate. If you want to minimize the number of adjusting journal entries, you could arrange for each period’s expenses to be paid in the period in which they occur.

Which of these is most important for your financial advisor to have?

To transfer what expired, Insurance Expense was debited for the amount used and Prepaid Insurance was credited to reduce the asset by the same amount. Any remaining balance in the Prepaid Insurance account is what you have left to use in the future; it continues to be an asset since it is still available. The adjusting entry ensures that the amount of supplies used appears as a business expense on the income statement, not as an asset on the balance sheet. The first journal entry is a general one; the journal entry that updates an account in this original transaction is an adjusting entry made before preparing financial statements. Under the accrual basis of accounting, the Service Revenues account reports the fees earned by a company during the time period indicated in the heading of the income statement.

What Are the Types of Adjusting Journal Entries?

Balance sheet accounts are assets, liabilities, and stockholders’ equity accounts, since they appear on a balance sheet. This is true because paying or receiving cash triggers a journal entry. This means that every transaction with cash will be recorded at the time of the exchange. We will not get to the adjusting entries and have cash paid or received which has not already been recorded. If accountants find themselves in a situation where the cash account must be adjusted, the necessary adjustment to cash will be a correcting entry and not an adjusting entry.

Types and examples of adjusting entries:

Conversely, if an adjustment entry is made to increase expenses, this will decrease the business’s profitability for that period. In the income statement, adjustment entries are used to update the values of revenue and expenses. For example, if a company has recognized revenue that has not yet been earned, an adjustment entry is made to remove this revenue from the income statement. Similarly, if a company has incurred an expense that has not yet been recognized, an adjustment entry is made to include this expense in the income statement.

- Each one of these entries adjusts income or expenses to match the current period usage.

- It is impossible to provide a complete set of examples that address every variation in every situation since there are hundreds of such Adjusting Entries.

- Each entry consists of a debit and a credit, and is recorded in accordance with the double-entry accounting system.

For instance, if a company forgets to record accrued wages at the end of the period, the expense will be understated, and net income will appear higher than it actually is. This misrepresentation can mislead stakeholders about the company’s profitability and financial health. Adjusting journal entries can get complicated, so you shouldn’t book them yourself unless you’re an accounting expert. Your accountant, however, can set these adjusting journal entries to automatically record on a periodic basis in your accounting software. That way you know that most, if not all, of the necessary adjusting entries are reflected when you run monthly financial reports.

Do you own a business?

In the balance sheet, adjustment entries are used to update the values of assets and liabilities. For example, if a company has an account receivable that is unlikely to be collected, an adjustment entry is made to reduce the value of the asset. Similarly, if a company has a liability that has increased in value, an adjustment entry is made to reflect this change.

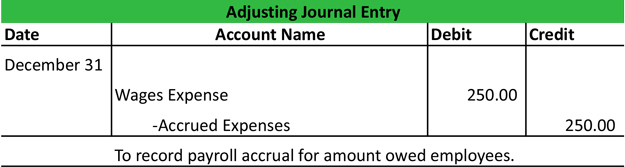

Since the expense was incurred in December, it must be recorded in December regardless of whether it was paid or not. In this sense, the expense is accrued or shown as a liability in December until it is paid. Unearned revenues are also recorded because these consist of income received from customers, but no goods or services have been provided to them. In this sense, the company owes the customers a good or service and must record the liability in the current period until the goods or services are provided.

The matching principle is a fundamental accounting principle that requires expenses to be matched with the revenues they generated. Adjustment entries ensure that all expenses and revenues are recorded in the correct period, even if they were not initially recorded. So, your income and expenses won’t match up, and you won’t be able to accurately track revenue.

Full-charge bookkeepers and accountants should be able to record them, though, and a CPA can definitely take care of it. The four types of adjustments in accounting include accruals, deferrals, reclassifications, and estimates. Accruals and deferrals involve adjusting entries to record transactions that have occurred but have not yet been recorded. Reclassifications involve moving amounts between accounts, while estimates involve adjusting amounts based on expected future events.

Here are the main financial transactions that adjusting journal entries are used to record at the end of a period. In December, you record it as prepaid rent expense, debited from an expense account. Then, come January, you want to record your rent expense for the month.

Mr. Jeff, an owner of Azon, wants to ensure the company’s inventory (or stock). On June 1, 2018, he purchased an insurance policy for a premium of $ 3000 for six months. During the month you will use some of these supplies, but you will wait until the end of the month to account for what you have used. Supplies are relatively inexpensive operating items used to run your business. When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 12 different Certificates of Achievement. 11 Financial is a registered investment adviser located in Lufkin, Texas.